“Signing” for the future

Your 5×1000 to the Corti Foundation is transformed into prevention, care, training, employment and development.

When filling out your tax return, don’t miss the opportunity to donate. The 5×1000 has no cost to the taxpayer, it’s just a matter of choosing the beneficiary “of the heart” and, with a simple signature, your contribution will reach whoever you wish.

(Italian tax-payers only).

Lacor Hospital: much more than a hospital

With your 5×1000 to the Corti Foundation, your signature turns into Prevention, care, training, work and development at Lacor Hospital.

Last year in northern Uganda, Lacor Hospital treated more than 200,000 people.

It housed as many as 900 students in its schools and wards and gave jobs to 700 Ugandans.

Their future starts here, at one of Equatorial Africa’s largest nonprofit hospitals.

Sign for us

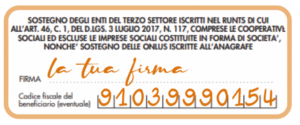

Make your tax return special: on the dedicated form, write our tax code 91039990154 and sign in the box “Support of third sector entities…” (“Sostegno degli enti del terzo settore…”).

Spread the word!

The 5×1000 is free. It is a donation that the state gives based on your preference: what better opportunity to help a unique project like Lacor? Tell everyone.

Just arm yourself with our tax code: 91039990154

Do like our ambassadors, donate 5×1000 too and tell your friends!

Deadlines

June 30: paper submission, via post office, of Income Form (formerly Unico)

Oct. 2: submission of both ordinary and pre-filled Form 730

Nov. 30: online submission of the Income Form (formerly Unico)

FAQ

What is 5×1000?

Five per thousand indicates a share of IRPEF tax that the Italian state distributes among entities that carry out socially relevant activities. Payment is at the discretion of the citizen-taxpayer, who makes his or her choice of destination at the same time as completing his or her tax return.

What do I need to do to donate 5×1000?

It’s very simple: just sign and enter the tax code of the entity (c.f: 91039990154) to which you want to donate your 5×1000 in the box of your tax return dedicated to “supporting Third Sector entities registered in the Runts.” (“sostegno degli enti del Terzo Settore iscritti nel Runts.”)

What happens if I don’t donate my 5×1000?

If you decide not to donate your 5×1000 to a specific entity, it will automatically be donated to the Government.

Who can donate 5×1000?

All individuals who are resident in Italy and have accrued taxable income in the tax year, as well as all those who file income tax returns, through the following forms: REDDITI (Formerly UNICO), CERTIFICATION UNICA, MODEL 730.

Does donating 5×1000 have a cost?

Absolutely not, since it is a share of the taxes you already pay.

What if I don’t file a tax return?

If you are a taxpayer who does not have to file a return, you can choose to donate five per thousand of your Irpef using the form attached to the Certificazione Unica (CU) or Form 730 or the Form Redditi Persone Fisiche (formerly Unico).

Fill out the card and place it in an envelope on which you will write ““Scheda per la scelta della destinazione del 5 per mille dell’IRPEF”,,” your name, surname and tax code.

You will be able to deliver it to a post office (free service), to an intermediary qualified for telematic transmission (professional, Caf…) or directly through the telematic services of the Internal Revenue Service.